The financial information included in this document is based on IFRS, as explained in Significant accounting policies, unless otherwise indicated.

This document contains certain forward-looking statements. By their nature, these statements involve risk and uncertainty. For more information, please refer to Forward-looking statements and other information.

References to the Company or company, to Philips or the (Philips) Group or group, relate to Koninklijke Philips N.V. and its subsidiaries, as the context requires. Royal Philips refers to Koninklijke Philips N.V.

This document comprises regulated information within the meaning of the Dutch Financial Markets Supervision Act (Wet op het financieel toezicht).

The chapters Group financial statements and Company financial statements contain the statutory financial statements of the Company. The introduction to the chapter Group financial statements sets out which parts of this Annual Report form the Management report within the meaning of Section 2:391 of the Dutch Civil Code.

In 2020, Philips again demonstrated its relevance in bringing meaningful innovation to improve people’s health and well-being, as we responded to the COVID-19 pandemic. As a company, we continue to focus on delivering against our triple duty of care – meeting critical customer needs, safeguarding the health and safety of our employees, and ensuring business continuity.

Our employees displayed flexibility and resourcefulness as we more than quadrupled output of acute care equipment and solutions to help frontline healthcare workers diagnose, treat, monitor and manage COVID-19 patients. We significantly increased production of critical care ventilators, provided ICU monitoring & analytics solutions, and rolled out telehealth solutions to relieve the pressure on scarce resources. And our field service engineers worked round the clock to support healthcare providers in their hour of need.

In parallel, we continued to support health systems with the delivery of regular care, entering into multiple long-term strategic partnerships – all featuring result-oriented business models – to transform healthcare by enhancing patient care and improving productivity. We also found new ways to serve consumers seeking to live a healthy life, prevent disease and proactively manage their own health. In total, our products and solutions improved the lives of 1.75 billion people in 2020, including 207 million people in underserved communities.

Overall, our company performance proved resilient. While some of our businesses were affected by lower demand, others were able to significantly increase deliveries. I would like to express my admiration and gratitude for the way in which the extended Philips family – our employees, our suppliers and partners, the Philips Foundation – pulled together with our customers to address the impact of the pandemic.

The developments of the past year validate our strategy to innovate the provision of care along the health continuum – putting the patient at the center, improving diagnosis and treatment pathways, enabling the integration of care across care settings, and increasing care provider productivity. At the same time, we help consumers to live healthier lifestyles and to cope with chronic disease. Increasingly, we are able to connect home and hospital care through telehealth platforms. This approach is resonating more strongly than ever.

Customers appreciate the comprehensive and strategic view we take of the future of health and healthcare. They want innovative solutions – smart combinations of systems, devices, informatics, data and services – that can help them deliver on the Quadruple Aim of better health outcomes, improved patient experience, improved staff experience, and lower cost of care. Given the learnings from COVID-19, they are especially keen to discover how we can support care outside the hospital.

In recent years, we have invested significantly in data science, informatics and cloud technology to enable the delivery of integrated solutions across the health continuum, and across care settings. These investments are now paying off, with a rapid increase in adoption of, for example, e-ICU and telehealth solutions that facilitate collaboration between health professionals and patient engagement.

Designed to address customer needs, our health technology innovations – supporting personal health, precision diagnosis, image-guided therapies and connected care, and leveraging the power of data and informatics – continue to generate a growing proportion of solutions-based sales and recurring revenues, which now stand at around 37% of total sales.

In healthcare the world over, we are seeing an increased focus on productivity and outcome-based models, as well as care outside the hospital. COVID-19 has accelerated the digitalization of care and the adoption of telehealth. This shift is being reinforced by global trends such as aging populations, the rise of chronic diseases, and resource constraints.

Innovative health technology can help health systems address these challenges, as well as extend access to care to those in need. The HealthTech market is a very attractive and sizable one, with considerable growth and margin potential, and Philips already holds strong leadership positions in over 65% of our portfolio.

Inspired by our purpose to improve people’s health and well-being, we invest almost 10% of revenue in Research & Development to innovate solutions that make a difference to our customers and society at large. Helping people to stay healthy and prevent disease, for instance through our expanding teledentistry services. Giving clinicians AI-assisted tools like our new Radiology Workflow Suite that help them make precision diagnoses and select the best care pathway. Helping surgeons deliver personalized, minimally invasive treatment with solutions like our constantly evolving Azurion image-guided therapy platform. And outside the hospital – orchestrating and delivering care in lower-cost care settings, helping people to recover, or live with chronic disease, at home.

All of these require a seamless flow of data, which is enabled by our highly secure connected care solutions, such as our IntelliVue MX750/MX850 patient monitors for the ICU. To unlock the full benefits of data-enabled care, we continue to expand our capabilities in informatics and data science, with around half of our R&D professionals working in these areas.

In 2020, we underscored our determination to lead by example by renewing our purpose – to improve people’s health and well-being through meaningful innovation, with the aim of improving 2 billion lives per year by 2025, including 300 million in underserved communities, rising to 2.5 billion and 400 million respectively by 2030.

This is part of an enhanced, fully integrated approach to doing business responsibly and sustainably. Building on our strong heritage in environmental and social responsibility, this new framework comprises a comprehensive set of key commitments across the Environmental, Social and Governance (ESG) dimensions that guide our endeavors. I am convinced this is the best way for Philips to create superior, long-term value for our many stakeholders.

I am pleased that we have delivered on all the targets set out in our Healthy people, Sustainable planet 2016-2020 program. As a purpose-driven company, we are conscious of our responsibility towards society and of the need to continue to embed sustainability ever deeper in the way we do business. Having become carbon-neutral in our own operations in 2020, we are now extending our ambitions and working with our partners to ensure that emissions across our entire value chain are in line to limit global warming to the 1.5 °C scenario.

We received further recognition for our efforts in this area in 2020 – achieving a CDP ‘A List’ rating for the eighth consecutive year for our action on climate change, and securing the second-highest place in both the global Dow Jones Sustainability Indices (DJSI) list and The Wall Street Journal’s new ranking, 100 Most Sustainably Managed Companies in the World.

COVID-19 impacted every part of our business in 2020. Nevertheless, despite the challenging circumstances, we were able to execute our plans and return to growth in the second half of the year. For the full year we delivered 3% comparable sales growth*) and a strong free cash flow*) of EUR 1.9 billion. Comparable order intake**) increased 9% and we made market share gains in a number of our health systems businesses.

Our Diagnosis & Treatment businesses were impacted by the ongoing postponement of capital equipment installations and routine care, including elective procedures, yet continued to deliver a steady flow of innovations designed to help clinicians deliver a precision diagnosis leading to targeted therapies.

Our Connected Care businesses posted exceptional growth, fueled by COVID-19-related demand for our hospital ventilation and monitoring & analytics solutions.

Our Personal Health businesses had to contend with a steep decrease in consumer demand brought about by the onset of COVID-19, yet rebounded strongly by accelerating online growth, increasing digital engagement, entering into partnerships with leading retailers, and scaling direct-to-consumer business models.

We initiated the process to create a separate legal structure for our Domestic Appliances business within the Philips Group, and we expect to complete this process by Q3 2021.

We made several acquisitions in 2020. For instance, we expanded our image-guided therapy devices portfolio, acquiring Intact Vascular to add an industry-first implantable device to treat peripheral artery disease. We also agreed to acquire BioTelemetry (completed on February 9, 2021) and Capsule Technologies to strengthen our Connected Care segment. These acquisitions will further broaden and scale our patient care management solutions for the hospital and the home, enhance patient outcomes, streamline clinical workflows and increase productivity.

Looking ahead, we continue to see uncertainty related to the impact of COVID-19 across the world. For 2021, Philips plans to deliver low-single-digit comparable sales growth*), driven by solid growth in Diagnosis & Treatment and Personal Health, partly offset by lower Connected Care sales, and an Adjusted EBITA margin*) improvement of 60-80 basis points.

Reflecting our confidence in the future course of the company and the importance we attach to dividend stability, we propose to maintain the dividend at EUR 0.85 per share.

As we continue our transformation into a customer-first solutions company, we are guided by our strategic roadmap, with its three key imperatives:

We aim to drive customer preference by getting even closer to our customers and consumers, making Philips easier to do business with, and further improving our quality, operational excellence and productivity. To do this, we are driving the digital transformation in every area of our business, leveraging our integrated IT landscape – from the way we connect and engage with our customers and consumers to seamlessly connecting our solutions, e.g. to enable remote servicing and upgrades.

In our core business we aim to drive growth through innovation by capturing geographic growth opportunities and by continuing the pivot to consultative customer partnerships and business models, which offer a deeper relationship, with recurring revenue streams.

We will also continue the shift towards integrated solutions with demonstrable clinical evidence and health economic benefits that help our customers achieve the Quadruple Aim. In doing so, we will leverage data science and AI at scale. Where appropriate, we will continue to make acquisitions and enter into partnerships to support our organic growth.

By working in accordance with the Philips Business System and executing on these imperatives with urgency and discipline, we will be able to create more value for our stakeholders – driving customer preference, sustained growth, margin expansion, increased cash flow and improved return on invested capital, while delivering on our ESG commitments.

Once again, I would like to thank our customers, suppliers and partners for working together with Philips in the fight against coronavirus. I also want to express my gratitude to our employees for their commitment, resourcefulness and hard work in difficult circumstances. And I wish to thank our shareholders for the confidence they continue to show in Philips.

Our strategic focus and commitment to improvement remain undiminished. Energized by our purpose and buoyed by the resilience and agility I have seen over the past year, I am confident in Philips’ ability to maintain our transformation momentum, truly impact global health challenges through innovation, and deliver sustained value for our many, diverse stakeholders.

Frans van Houten

Chief Executive Officer

Royal Philips has a two-tier board structure consisting of a Board of Management and a Supervisory Board, each of which is accountable to the General Meeting of Shareholders for the fulfillment of its respective duties. The Board of Management is entrusted with the management of the company. The other members of the Executive Committee have been appointed to support the Board of Management in the fulfilment of its managerial duties. Please also refer to Board of Management and Executive Committee within the chapter Corporate governance.

Born 1961, Indian

Executive Vice President

Member of the Board of Management since December 2015

Chief Financial Officer

Abhijit Bhattacharya first joined Philips in 1987 and has held multiple senior leadership positions across various businesses and functions in Europe, Asia Pacific and the U.S. Through 2010 – 2014, he was the Head of Investor Relations of Philips, and subsequently, CFO of Philips Healthcare, Philips’ largest sector at the time. Prior to 2010, Abhijit was Head of Operations & Quality at ST-Ericsson, the joint venture of ST Microelectronics and Ericsson, and he was CFO of NXP’s largest business group.

Born 1973, Dutch/American

Executive Vice President

Member of the Board of Management since November 2017

Chief Legal Officer

Marnix van Ginneken joined Philips in 2007 and became Head of Group Legal in 2010. In this role he was responsible for the various Group Legal departments, including Corporate & Financial Law, Legal Compliance and Legal M&A. In 2014, Marnix became Chief Legal Officer of Royal Philips and Member of the Executive Committee. Before joining Philips, Marnix worked for Akzo Nobel and before that as an attorney in a private practice. Since 2011, he is also Professor of International Corporate Governance at the Erasmus School of Law in Rotterdam.

For a current overview of the Executive Committee members, see also https://www.philips.com/a-w/about/executive-committee.html

At Philips, our purpose to improve people’s health and well-being through meaningful innovation is at the heart of everything we do. Never has this central tenet been more important than it is now, in these challenging times.

As a leading health technology company, we believe that innovation can improve people's health and healthcare outcomes, as well as making care more accessible and affordable. In concrete terms, we aim to improve the lives of 2 billion people a year by 2025, including 300 million in underserved communities, rising to 2.5 billion and 400 million respectively by 2030.

Guided by this purpose, it is our strategy to lead with innovative solutions that combine systems, smart devices, informatics and services, and leverage big data – helping our customers deliver on the Quadruple Aim (better health outcomes, improved patient experience, improved staff experience, lower cost of care) and helping people to take better care of their health at every stage of life.

We strive to deliver superior, long-term value to our customers and shareholders, while acting responsibly towards our planet and society, in partnership with our stakeholders.

We aim to grow Philips responsibly and sustainably. To this end, we have deployed a comprehensive set of commitments across all the Environmental, Social and Governance (ESG) dimensions that guide the execution of our strategy and support our contribution to UN Sustainable Development Goals 3 (Ensure healthy lives and promote well-being for all at all ages), 12 (Ensure sustainable consumption and production patterns) and 13 (Take urgent action to combat climate change and its impacts).

Health technology is a large market, which is expected to grow by around 4% each year*). Besides the natural drivers of growth – aging populations, the rise of chronic diseases, increased spending on healthcare in emerging markets – we believe that health technology will be a major growth driver in the years to come.

At Philips, we see healthcare as a continuum, since it puts people’s health journeys front and center and builds upon the idea of integrated care pathways. Believing that healthcare should, and can, be seamless, efficient and effective, we strive to ‘connect the dots’ for our customers and consumers, supporting the flow of data needed to care for people in real time, wherever they are.

Going forward, the digitalization of healthcare and – accelerated by COVID-19 – the more widespread adoption of telehealth will play an increasing role in helping people to live healthily and cope with disease, and in enabling care providers to meet people’s health needs, deliver better outcomes and improve productivity.

In the consumer domain, we develop innovative solutions that support healthier lifestyles, prevent disease, and help people to live well with chronic illness, also in the home and community settings.

In addition to leveraging retail trade partnerships and new business models, we are accelerating growth through online channels, delivering products and services direct to consumers, and supporting longer-term relationships to maximize the benefit consumers can derive from our solutions.

In clinics and hospitals, we are teaming up with healthcare providers to innovate and transform the way care is delivered. We listen closely to our customers’ needs and together we co-create solutions that help our customers improve outcomes, patient and staff experience and productivity, and so deliver on the Quadruple Aim of value-based care.

Increasingly, we are working together with our health systems customers in novel business models, including outcome-oriented payment models, that align their interests and ours in long-term partnerships. The combination of compelling solutions and consultative partnership contracts, including a broad range of professional services, drives growth rates above the group average, as well as a higher proportion of recurring revenues.

We are embedding AI and data science in our propositions – for instance, applying the power of predictive data analytics and artificial intelligence at the point of care – to leverage the value of data in the clinical and operational domains, aiding clinical decision making and improving the quality and efficiency of healthcare services.

With our global reach, market leadership positions, deep clinical and technological insights, and innovation capability, we are strongly placed to create further value in a changing healthcare world through our propositions in:

Delivering solutions that enable healthier lifestyles, personal hygiene and living with chronic disease.

Driving better care management by seamlessly connecting patients and caregivers from the hospital to the home.

Our roadmap – with its three strategic imperatives – is our guide as we continue our transformation journey to attain HealthTech industry leadership and drive value creation.

Underpinned by these strategic imperatives, and assuming the world economy will return to growth in 2021, Philips’ targets for accelerated growth, higher profitability and improved cash flow for the 2021–2025 period are:

The new targets exclude the Domestic Appliances business. As announced in January 2020, Philips is reviewing options for future ownership of its Domestic Appliances business. Philips has started the process of creating a separate legal structure for this business within the Philips Group, which is expected to be completed in the third quarter of 2021.

Based on the International Integrated Reporting Council framework, and with the Philips Business System at the heart of our endeavors, we use various resources to create value for our stakeholders in the short, medium and long term.

As we drive our transformation to become a solutions provider to our customers and consumers, we have adopted a single standard operating model that defines how we work together effectively to achieve our company objectives – the Philips Business System (PBS). The PBS integrates key aspects of how we operate:

Having a single business system increases speed and agility, and enhances standardization, quality and productivity, while driving a better, more consistent experience for our customers.

The resources and relationships that Philips draws upon for its business activities

The result of the application of the various resources to Philips’ business activities and processes as shaped by the Philips Business System

The societal impact of Philips through its supply chain, its operations, and its products and solutions

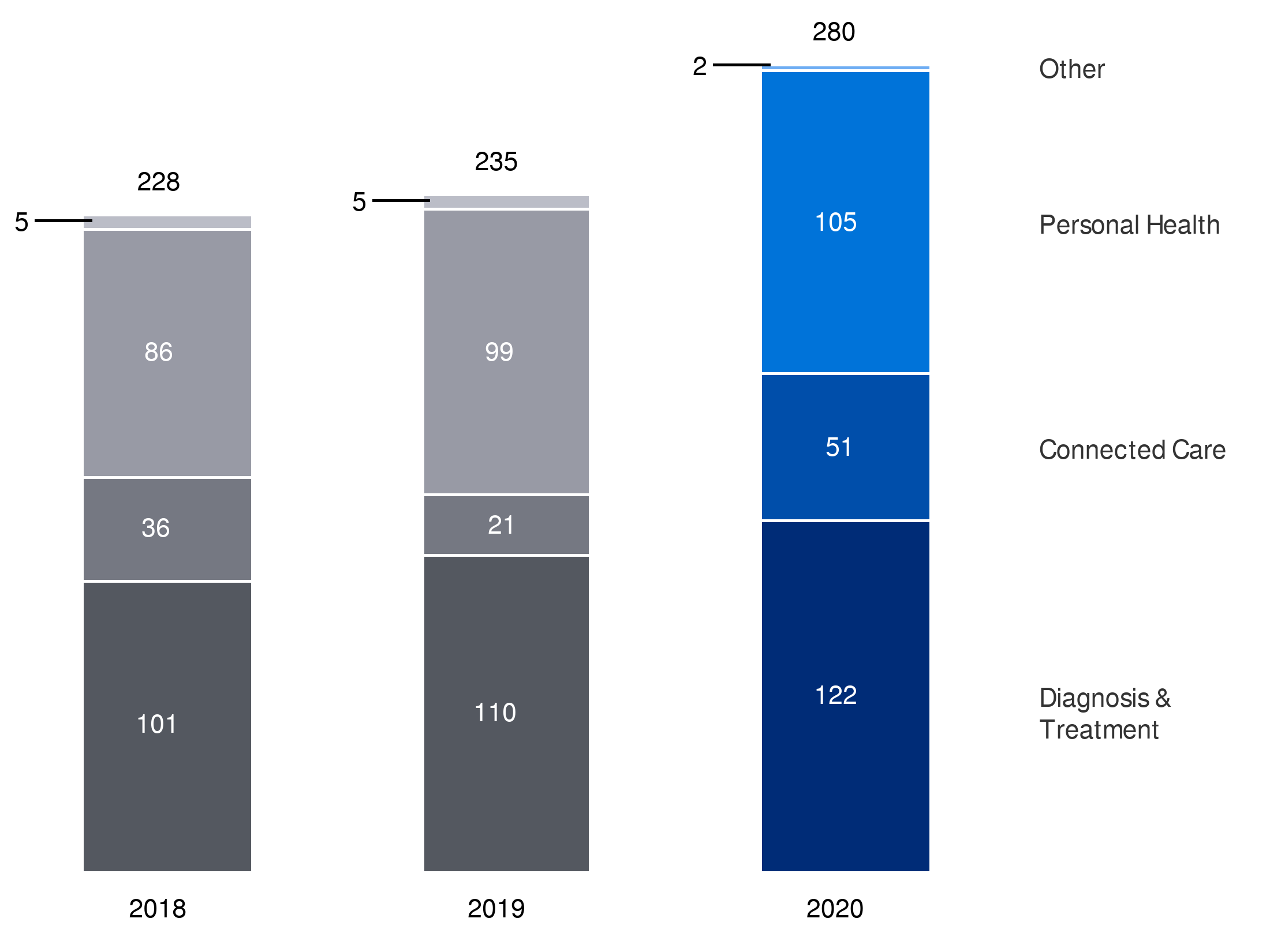

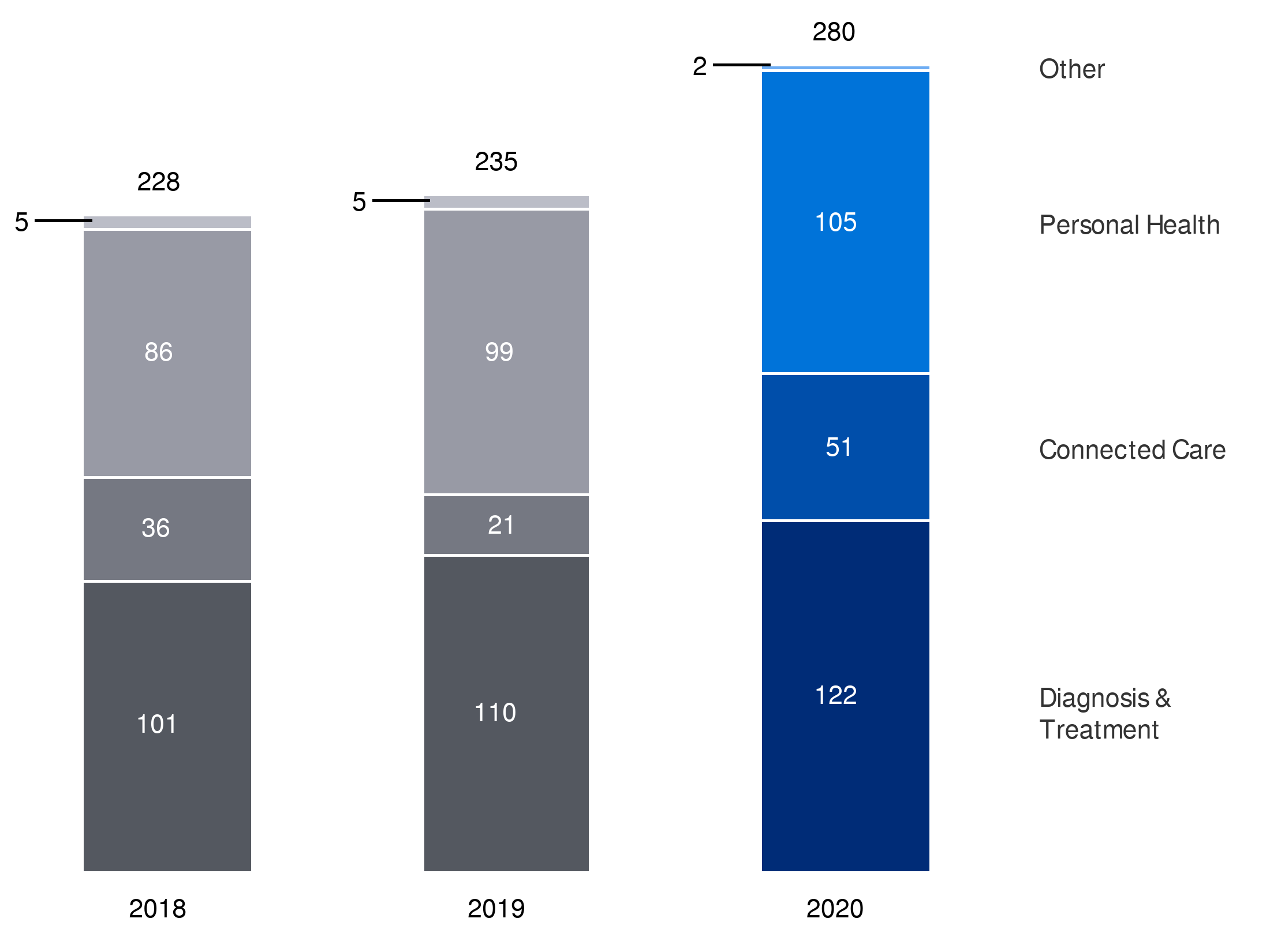

Koninklijke Philips N.V. (Royal Philips) is the parent company of the Philips Group. In 2020, the reportable segments were Diagnosis & Treatment businesses, Connected Care businesses, and Personal Health businesses, each having been responsible for the management of its business worldwide. Additionally, Philips identifies the segment Other.

Philips Group

Total sales by reportable segment

| 2020 | |

|---|---|

| Diagnosis & Treatment | 42% |

| Connected Care | 28% |

| Personal Health | 28% |

| Other | 2% |

Our Diagnosis & Treatment businesses create value through their unique portfolio of innovative diagnostic and minimally invasive procedural solutions – suites of systems, smart devices, software and services powered by AI-enabled informatics. With these integrated solutions, we enable our customers to realize the full potential of the Quadruple Aim – better health outcomes, improved patient experience, improved staff experience, and lower cost of care.

In Precision Diagnosis, serving diagnostic enterprise imaging markets globally, there is significant opportunity to enable precise diagnoses while at the same time supporting adjacent needs for guidance into care pathways and increasing departmental productivity. We do this through breakthrough innovations in our smart diagnostic systems, through dynamic workflow solutions that transform departmental operations, through integrated diagnostics insights from different departments, and through care pathway solutions that allow doctors to diagnose with precision and select the optimal treatment path for the individual patient. Over the period 2019-2020, 60% of our product portfolio in this area has been renewed through the discontinuance of former products, the roll-out of new-generation versions of our products, and the addition of new products.

In Image Guided Therapy, we have pivoted from a focus on imaging modalities to integrated procedural solutions combining systems and therapeutic devices, which can drive more effective treatment, better outcomes and higher productivity. Building upon our leading-edge Azurion platform, we continue to innovate and expand our applications for image-guided therapies and improve workflow and integration in the interventional suite. We are also expanding into adjacent therapeutic areas and innovating the way we engage with our customers in new business models across different care settings, including out-of-hospital settings such as office-based labs and ambulatory surgical centers, which offer clear clinical, financial and operational benefits.

In 2020, the Diagnosis & Treatment businesses were impacted by the postponement of capital equipment installations and routine care, including elective procedures and exams, caused by the COVID-19 pandemic. Even so, we continued to make advances in innovation and in strengthening our portfolio. For example, we expanded our remote clinical collaboration and virtual training offerings across our portfolio with the acquisition of Innovative Imaging Technologies (IIT) and its Reacts collaborative platform. Leveraging innovative technologies, such as augmented reality for remote virtual guidance, supervision and training, the platform provides unique interactive tools designed to meet the multi-faceted collaborative needs of healthcare professionals and patients. We also launched the vendor-agnostic Radiology Workflow Suite of end-to-end solutions to drive operational and clinical efficiency through the digitalization, integration, and virtualization of radiology. And we further expanded our Interventional Devices portfolio, acquiring Intact Vascular to add an industry-first implantable device, the Tack Endovascular System, to treat peripheral artery disease.

Through our various businesses, Diagnosis & Treatment is focused on growing market share and profitability by leveraging:

In 2020, the Diagnosis & Treatment segment consisted of the following areas of business:

Diagnosis & Treatment

Total sales by business

| 2020 | |

|---|---|

| Diagnostic Imaging | 41% |

| Ultrasound | 20% |

| Enterprise Diagnostic Informatics | 8% |

| Image Guided Therapy | 31% |

Revenue is predominantly earned through the sale of products, leasing, customer services fees, recurring per-procedure fees for disposable devices, and software license fees. For certain offerings, per-study fees or outcome-based fees are earned over the contract term.

Sales channels are a mix of a direct sales force, especially in all the larger markets, third-party distributors and an online sales portal. This varies by product, market and price segment. Our sales organizations have an intimate knowledge of technologies and clinical applications, as well as the solutions necessary to solve problems for our customers.

Under normal circumstances, sales at Philips’ Diagnosis & Treatment businesses are generally higher in the second half of the year, largely due to the timing of customer spending patterns.

At year-end 2020 Diagnosis & Treatment had around 32,000 employees worldwide.

At the Radiological Society of North America event RSNA 2020, Philips introduced an industry-first vendor-neutral Radiology Operations Command Center as part of the Radiology Workflow Suite of solutions. This multimodality virtual imaging command center enables real-time, remote collaboration to broaden expertise between technologists, radiologists and imaging operations teams across multiple sites via private, secure telepresence capabilities. Proprietary digital technology developed by Philips helps maintain business continuity, increase enterprise-wide radiology productivity, minimize issues with image quality, and expand access to advanced MR- and CT-based diagnosis.

We introduced the next generation of our leading-edge Azurion image-guided therapy platform. An industry first, the Philips Azurion image-guided therapy platform now fully integrates IntraSight to control imaging, physiology, hemodynamic and informatics applications with one intuitive user control at the tableside. With this next-generation Azurion platform, Philips is also introducing a new 3D imaging solution, called SmartCT, to dramatically simplify the acquisition and use of 3D imaging. Next-generation Azurion comprises a new range of configurations – covering more price segments – to innovate procedures in a broad range of therapeutic areas.

We continue to see strong traction for our Ingenia Ambition 1.5T MR, which combines fully sealed BlueSeal magnet technology and workflow innovations for more productive, helium-free operations. As well as virtually eliminating dependency on a commodity with an unpredictable supply, the fully sealed system does not require a vent pipe, significantly reducing the typical MR installation challenges and lowering construction costs.

Philips signed a seven-year strategic partnership agreement with Mandaya Royal Hospital Puri in Indonesia. The turnkey solution includes the next-generation Azurion image-guided therapy system, the Ingenia Ambition MR, and the detector-based IQon Spectral CT, as well as the latest innovations in connected care and informatics.

SimonMed Imaging – one of the largest outpatient medical imaging providers in the US – is partnering with Philips to deploy its most advanced 3T MRI technology, including software and services, at their outpatient practices to enhance diagnoses, from brain injuries, liver and cardiac disease, to orthopedic injuries.

In Germany, Philips signed a 10-year strategic partnership with Marienhospital Stuttgart to deploy our digital healthcare solutions across multiple departments to improve patient care and efficiency. The project will include renewal and ongoing development of the hospital’s diagnostic imaging equipment and associated IT systems, digitization of its pathology department, and enhancement of the hospital’s emergency medicine capabilities.

Philips expanded its dedicated cardiovascular ultrasound offering by launching Affiniti CVx. This system is designed to support cardiology departments in delivering better care to more patients with increased efficiency and throughput.

Philips received an industry-first 510(k) clearance from the FDA to market a wide range of its ultrasound solutions – including our CX50 general imaging system and our Lumify portable ultrasound solution – for the management of COVID-19-related lung and cardiac complications. Portable ultrasound solutions in particular have become valuable tools for clinicians treating COVID-19 patients, due to their imaging capabilities, portability and ease of disinfection.

Philips continued to advance the capabilities of its KODEX-EPD cardiac imaging and mapping system for the treatment of heart rhythm disorders, improving image quality and workflow efficiency for Atrial Fibrillation procedures.

Philips announced a partnership with InSightec to expand access to MR-guided focused ultrasound for incisionless neurosurgery. By developing compatibility between Philips’ advanced MR systems and the Exablate Neuro platform from InSightec, the two companies will support expanded access to MR-guided focused ultrasound for the treatment of Essential Tremor and other neurological disorders.

Philips introduced OmniWire, the world’s first solid core pressure guide wire for physiology measurement in coronary artery interventional procedures; it has been extremely well received by our customers.

In January 2021, Philips announced the final, five-year results of two major randomized controlled trials (RCTs) that show no difference in all-cause mortality between patients treated with the Stellarex drug-coated balloon (DCB) and those treated with percutaneous angioplasty (PTA), the current standard of care. Moreover, the studies showed no difference in mortality between the Stellarex DCB and PTA at every 12-month endpoint over the course of the study.

Spanning the entire health continuum, the Connected Care businesses help broaden the reach and deepen the impact of healthcare with solutions that leverage and unite devices, informatics, data and people across networks of care, to enable our customers to deliver on the Quadruple Aim – better health outcomes, improved patient experience, improved staff experience, and lower cost of care.

In 2020, Connected Care played a crucial role in fulfilling customer needs created by the COVID-19 global pandemic, from ramping up production and delivery of our core systems such as ventilators and monitors, to supporting the urgent expansion of telehealth for the ICU, and driving safe, remote patient care.

Although no one was fully prepared for this crisis, Philips had the critical portfolio and the informatics investments in place to rapidly scale up, supporting care in the hospital and the home, even as healthcare delivery models were changing fast.

Philips increased ventilator production multifold to meet the high COVID-19-related demand, and shipped ventilators across the world using a fair and ethical approach to allocate supply to acute patient demands based on COVID-19 data and the available critical care capacity.

This past year showed the value of strong leadership positions and close ties with our customers. Building on Philips’ trusted brand, deep clinical insights and large installed base allowed us to drive impact. Philips combined the right monitoring equipment, respiratory devices, consumables and services to innovate solutions to help tackle COVID-19.

Also critical during COVID-19: the expertise and informatics to help scale and manage scarce resources in the health system. The capabilities in Connected Care are built around Philips’ strength in verticals (monitoring & analytics, sleep & respiratory care, and therapeutic care) and horizontals (connected care informatics and population health) to improve clinical and economic outcomes in all care settings, both inside and outside the hospital.

Philips has a deep understanding of clinical care and the patient experience. When coupled with our consultative approach, this allows us to be an effective partner for transformation, both across the enterprise and at the level of the individual clinician. These services are designed to take the burden off hospital staff with optimized patient and data flow, predictive analytics, improved workflow, customized training and improved accessibility across our application landscape.

This requires a secure common digital platform that connects and aligns consumers, patients, payers and healthcare providers. Philips’ platforms aggregate and leverage information from clinical, personal and historical data to support care providers in delivering precision diagnoses and treatment.

In 2020, the Connected Care segment consisted of the following areas of business:

Connected Care

Total sales by business

| 2020 | |

|---|---|

| Monitoring & Analytics | 40% |

| Sleep & Respiratory Care | 49% |

| Therapeutic Care | 5% |

| Connected Care Informatics and Population Health Management | 6% |

In most of the Connected Care businesses, revenue is earned through the sale of products and solutions, customer services fees and software license fees. Where bundled offerings result in solutions for our customers, or offerings are based on the number of people being monitored, we see more usage-based earnings models. In Sleep & Respiratory Care, revenue is generated both through product sales and through rental models, whereby revenue is generated over time.

Sales channels include a mix of a direct salesforce, partly paired with an online sales portal and distributors (varying by product, market and price segment). Sales are mostly driven by a direct salesforce with an intimate knowledge of the procedures that use our integrated solutions’ smart devices, systems, software and services. Philips works with customers and partners to co-create solutions, drive commercial innovation and adapt to new models such as monitoring-as-a-service.

Sales at Philips’ Connected Care businesses are generally higher in the second half of the year, largely due to customer spending patterns. In 2020 this pattern shifted due to the outbreak of the COVID-19 pandemic.

At year-end 2020, the Connected Care businesses had around 16,000 employees worldwide.

In the face of the global shortage of ventilators and patient monitors upon the outbreak of the COVID-19 pandemic, we worked intensively, together with our supply chain partners around the world, to drive a massive ramp-up in production, increasing ventilator manufacturing eightfold and monitor production fivefold.

Philips introduced Rapid Equipment Deployment Kits for ICU ramp-ups, allowing doctors, nurses, technicians and hospital staff to quickly support critical care patients. The kit combines Philips’ advanced patient monitoring technology with predictive, patient-centric algorithms for scale-up within hours.

Philips launched several new monitoring solutions for the Intensive Care Unit (ICU), the general ward and the home that feature remote monitoring capabilities and advanced analytics. These include Philips’ IntelliVue Patient Monitors MX750/MX850 for the ICU, Philips’ Biosensor BX100 for early patient deterioration detection in the general ward, and in collaboration with BioIntelliSense, the BioSticker medical device to help monitor at-risk patients from the hospital to the home, to help avoid hospital re-admissions and to support chronic care management.

Philips introduced several dedicated telehealth solutions to help relieve the tremendous pressure placed on scarce resources by the growing number of COVID-19 patients. Based on its proven Patient Reported Outcomes Management solution, which is being used by more than 100 healthcare institutions globally, Philips enabled Dutch hospitals and GPs to remotely screen and monitor patients with COVID-19.

In December 2020, Philips announced the intended acquisition of BioTelemetry Inc., a leading remote cardiac diagnostics and monitoring company in the US, with solutions comprised of wearable connected heart monitors, AI-based data analytics and a services platform. The transaction was completed on February 9, 2021. The combination of Philips’ leading patient monitoring position in the hospital with BioTelemetry’s leading cardiac diagnostics and monitoring position outside the hospital is expected to result in a global leader in patient care management solutions for the hospital and the home for cardiac and other patients.

In January 2021, Philips announced that it has signed an agreement to acquire Capsule Technologies, Inc., a leading provider of medical device integration and data technologies for hospitals and healthcare organizations. The combination of Philips’ industry-leading portfolio with Capsule’s leading Medical Device Information Platform, connected through Philips’ secure vendor-neutral cloud-based HealthSuite digital platform, will enrich and scale Philips’ patient care management solutions for all care settings in the hospital, as well as remote patient care. The transaction is expected to be completed in the first quarter of 2021.

Highlighting its strength in strategic partnerships to enhance patient care and improve care provider productivity, Philips signed multiple new agreements. For example, Philips and the US Department of Veterans Affairs entered a 10-year agreement to expand their tele-critical care program, creating the world’s largest system to provide veterans with remote access to intensive care expertise, regardless of their location.

University of Kentucky HealthCare teamed up with Philips to implement the company’s tele-ICU technology to enhance patient care and improve utilization and patient flows across 160 ICU beds at the academic medical center’s two hospitals. Leveraging Philips’ acute telehealth platform, eCareManager, UK HealthCare is implementing the state’s first centralized virtual care model to help nurses detect risk of patient deterioration, so they can intervene earlier and help improve care outcomes.

Supporting the increased demand for flexible ICU capacity, Philips introduced its new mobile ICUs in India. The ICUs can be furnished with a range of medical equipment, including ventilators, defibrillators, and patient monitoring.

Our Personal Health businesses play an important role on the health continuum – in the healthy living, prevention and home care stages – delivering integrated and connected solutions.

Leveraging our deep consumer expertise and extensive healthcare know-how, we enable people to live a healthy life in a healthy home environment, and to proactively manage their own health.

We aim to drive profitable growth through a relentless focus on innovation across three key areas:

In 2020, the Personal Health segment consisted of the following areas of business:

Personal Health

Total sales by business

| 2020 | |

|---|---|

| Oral Healthcare | 21% |

| Mother & Child Care | 6% |

| Personal Care | 32% |

| Domestic Appliances | 41% |

Through our Personal Health businesses, we offer a broad range of solutions in various consumer price segments, always aiming to offer and realize premium value. We continue to rationalize our portfolio of locally relevant innovations and increase its accessibility, particularly in lower-tier cities in growth geographies. A notable aspect of our commercial strategy is driving increased direct-to-consumer relationships and sales through our consumer communities and online store. We believe we are well positioned to capture further growth in online sales and continue to build our digital and e-commerce capabilities.

We are leveraging connectivity to offer new business models, partnering with other players in the health ecosystem, e.g. insurance companies, with the goal of extending opportunities for people to live healthily, prevent or manage disease. We are engaging consumers in their health journey in new and impactful ways through social media and digital innovation.

For example, the Philips Sonicare app acts as a ‘virtual hub’ for personal oral healthcare, helping users to manage their complete oral care on a daily basis and share brushing data with their dental practitioners, putting personalized guidance and advice at their fingertips. In our drive to innovate oral healthcare, we are partnering with leading insurance companies, which are moving to more preventative models of care. To that end, they need to encourage consumers to brush twice per day, for two minutes at a time, as that leads to better health outcomes and lower cost of care. The first results from the pilot program are extremely promising. Solutions and services like this offer a win-win for consumers and insurers: for consumers, because they get better oral care, and for insurance companies, because they have less cost per patient.

We also offer mobile solutions to support parents and parents-to-be for a more informed, more connected and healthier journey to parenthood. Powered by personalized AI and deep analytics, the Pregnancy+ app and Baby+ app offer parents supportive content at every stage of their first 1,000-day journey. Pregnancy+ also offers state-of-the-art, photo-realistic and interactive 3D fetal models to make the experience even more exciting. In 2020, to help expectant mothers navigate pregnancy in times of the pandemic, we introduced an in-app COVID-19 guide. As of year-end 2020, the Pregnancy+ app and Baby+ app combined have almost 2 million daily active users in over 50 countries.

The company’s wide portfolio of connected consumer health platforms leverages Philips HealthSuite, a cloud-enabled connected health ecosystem of devices, apps and digital tools that enable personalized health and continuous care.

The revenue model is mainly based on product sale at the point in time the products are delivered to retailers and online platforms. We are increasingly diversifying the revenue model with new business models, including direct-to-consumer, subscriptions and services.

The Personal Health businesses experience seasonality, with higher sales around key national and international events and holidays.

At year-end 2020, Personal Health employed around 17,000 people worldwide.

Broadening its leading portfolio of power toothbrushes, the company launched the Philips One by Sonicare. An entry-level proposition to expand into new consumer segments, Philips One is a battery-operated power toothbrush developed as a step up from manual brushing. Users of this toothbrush can opt into a subscription service for brush head and battery replacements.

A new teledentistry platform for dental professionals – announced together with dental technology company Toothpic – provides a tool to build direct patient engagement, acquisition and retention while improving office efficiency, in-chair time and remote care.

To support parents in their breastfeeding journey, Philips Avent launched a new Electric Breast Pump. This unique expression solution uses Natural Motion Technology to mimic a baby’s suckling, while also adapting to the size and shape of a mother’s nipple for a comfortable and quicker milk flow.

Philips has introduced a series of shavers featuring SkinIQ technology, which senses, guides and adapts to men’s skin and facial hair for a close and comfortable shave. The shaver’s inbuilt Motion Control sensor checks for effective circular motions and provides real-time feedback through the Philips GroomTribe app, allowing men to achieve a more effective and comfortable technique, with fewer passes.

The Philips Lumea hair removal device with Intense Pulsed Light technology continued to grow in 2020 thanks to superior product quality and the coaching app – both well-received with high consumer ratings – and through faster access to product via the new Try & Buy business model.

Philips set an environmental milestone with the launch of the Viva Café Eco coffee machine, our first product to have all visible plastic parts and non-food-contact parts made from recycled materials.

In our external reporting on Other we report on the items Innovation & Strategy, IP Royalties, Central costs, and other small items. At year-end 2020, around 17,000 people worldwide were working in these areas.

The Innovation & Strategy organization includes the Chief Technology Office (CTO), Research, HealthSuite Platforms, the Chief Medical Office, Product Engineering, Experience Design, Strategy, and Sustainability. Our four largest Innovation Hubs are in Eindhoven (Netherlands), Cambridge (USA), Bangalore (India) and Shanghai (China).

Innovation & Strategy, in collaboration with the operating businesses and the markets, is responsible for directing the company strategy, in line with our growth and profitability ambitions.

The Innovation & Strategy function facilitates innovation from ‘idea’ to ‘market’ (I2M) as co-creator and strategic partner for the Philips businesses, markets and partners. It does so through cooperation between research, design, medical affairs, marketing, strategy and businesses in interdisciplinary teams along the innovation chain, from exploration and advanced development to first-of-a-kind proposition development. In addition, it opens up new value spaces beyond the direct scope of current businesses, manages the R&D portfolio, and creates synergies for cross-segment initiatives and integrated solutions.

Innovation & Strategy actively participates in Open Innovation through relationships with academic, clinical, industrial partners and start-ups, as well as via public-private partnerships. It does so in order to improve innovation speed, effectiveness and efficiency, to capture and generate new ideas, and to leverage third-party capabilities. This may include sharing the related financial exposure and benefits.

Finally, Innovation & Strategy sets the agenda and drives continuous improvement in the Philips product and solution portfolio, the efficiency and effectiveness of innovation, the creation and adoption of (digital) platforms, and the uptake of high-impact technologies such as Data Science, Artificial Intelligence (AI) and the Internet of Things (IoT). Centers of Excellence – knowledge hubs built around critical capabilities and technology – play a key role in maximizing the impact of innovations for Philips.

The Chief Technology Office orchestrates innovation strategy and portfolio management, drives adoption of digital architecture and platforms, as well as excellence in software, Data Science and AI, across Philips’ businesses and markets. Philips Research initiates game-changing innovations that disrupt and cross boundaries in health technology to address opportunities for better clinical and economic outcomes and support the associated transformation of Philips into a digital solutions company. CTO and Research encompass the following organizations:

The Product Engineering organization is accountable for building world-class Idea to Market (I2M) capabilities and for driving excellence in product engineering across Philips worldwide.

Philips HealthSuite is at the core of Philips’ digital transformation. It consists of a highly secured, modular set of capabilities that can liberate and integrate data from disparate systems and accelerate the development and deployment of digital propositions across the health continuum in a secure cloud environment, connecting consumer and medical IoT devices safely and reliably, and providing sophisticated care management applications to support care teams and patients alike.

To drive innovation effectiveness and efficiency, and to enable locally relevant solution creation, we have established four Innovation Hubs for the Philips Group: Eindhoven (Netherlands), Cambridge (USA), Bangalore (India) and Shanghai (China). The four hubs form a global network, together with the other smaller innovation and research sites in their respective regions, to provide access to each other’s capabilities to serve businesses, markets and customers globally.

Alongside the hubs, where most of the central Innovation & Strategy organization is concentrated together with selected business R&D and market innovation teams, we continue to have significant, more focused innovation capabilities integrated into key technology centers at our other global business sites.

The Chief Medical Office is responsible for clinical innovation and strategy, healthcare economics, clinical evidence and market access, clinical education, as well as medical thought leadership, with a focus on healthcare governance and organization, the Quadruple Aim and value-based care. This includes engaging with stakeholders across the health continuum to extend Philips’ leadership in health technology and acting on new value-based reimbursement models that benefit the patient, health professional and care provider.

Leveraging the knowledge and expertise of the medical professional community across Philips, the Chief Medical Office includes many healthcare professionals who practice(d) in the world’s leading health systems. Its activities include strategic guidance built on clinical and scientific knowledge, building customer partnerships and growth opportunities, fostering peer-to-peer relationships in relevant medical communities, liaising with medical regulatory bodies, and supporting clinical and marketing evidence development.

Philips Experience Design is the global design function for the company, ensuring that the user experiences of our innovations are meaningful, people-focused and locally relevant. It is also responsible for ensuring that the Philips brand experience is distinctive, consistently expressed across all customer touchpoints, and drives customer preference. A key enabler for this is a consistent and differentiating design language that applies to software, hardware and services across our businesses. Philips Experience Design partners with stakeholders across the organization to develop methodologies and enablers for defining value propositions, as well as to implement data-enabled design tools and processes to create meaning from data. Philips Experience Design received 151 awards for design excellence in 2020.

In partnership with Philips Experience Design, Philips Healthcare Transformation Services (HTS) leverages Co-create methodologies with the aim of creating solutions that are tailored specifically to the challenges facing our customers, as local circumstances and workflows are key ingredients in the successful implementation of solutions. HTS is a team of healthcare transformation practitioners with consulting skills and a portfolio of methods and tools in operational and clinical excellence, environmental and experience design, and technology transformation and analytics.

Philips Intellectual Property & Standards (IP&S) proactively pursues the creation of new Intellectual Property (IP) in close co-operation with Philips’ operating businesses and Innovation & Strategy. IP&S is a leading industrial IP organization providing world-class IP solutions to Philips’ businesses to support their growth, competitiveness and profitability.

Royal Philips’ total IP portfolio currently consists of 62,000 patent rights, 37,000 trademarks, 104,000 design rights and 3,200 domain names. Philips filed 876 new patents in 2020, with a strong focus on the growth areas in health technology services and solutions.

Philips earns substantial annual income from license fees and royalties. These are mostly earned on the basis of usage or fixed fees, recognized over the term of the contract or at a point in time.

Philips believes its business as a whole is not materially dependent on any particular third-party patent or license, or any particular group of third-party patents and licenses.

We recharge the directly attributable part of the central costs to the business segments. The remaining part is accounted for as central costs, and includes costs related to the Executive Committee and Group functions such as Strategy, Legal and Audit fees.

Philips is present in more than 75 countries globally and has its group headquarters in Amsterdam, Netherlands. Our real estate sites are spread around the globe, with key manufacturing and R&D sites in Europe, the Americas and Asia.

In 2020, we opened prime locations in Cambridge and Pittsburgh (USA) and substantially invested in our campus in Eindhoven-North (Netherlands), to create an engaging workplace that will help attract and retain the best talent. We have driven productivity by optimizing our footprint globally and reduced the number of sites through post-acquisition integration programs.

In line with our Environmental ESG commitment towards 2025, as well as our commitment to the UN Sustainable Development Goals, we are actively optimizing our real estate portfolio. Since 2018, our site-related CO2 emissions related to fossil fuel consumption have been reduced by over 10%, and we have met our goal of bringing those CO2 emissions under 35 kilotonnes per year.

The vast majority of our locations consist of leased property, and we manage these closely to keep the overall vacancy rates of our property below 5% and to ensure the right level of space efficiency and flexibility to follow our business dynamic. Occupancy rates in Philips office locations were reduced during 2020 as a result of COVID-19 and this trend is expected to continue in 2021. The net book value of our land and buildings at December 31, 2020, represented EUR 1,374 million; construction in progress represented EUR 65 million. Our current facilities are adequate to meet the requirements of our present and foreseeable future operations.

We operate three market groups – North America, Greater China and International Markets (consisting of seven regions) – which are active in more than 100 countries worldwide.

The Markets’ core objective is to understand local market/customer needs, to develop and manage the relationship with existing and new customers, and to deliver orders. As such, the market organizations are also responsible for the market-oriented profit-and-loss account (P&L) and balance sheet. They translate the voice of the customer into the innovation process, bring relevant products and solutions to market, and ensure local (solution) delivery and service execution, as well as managing the (integral) go-to-market approaches to our key customers and indirect channels – all with the aim of maximizing long-term customer value and gaining market share.

To take quick decisions that are locally relevant and as close to the customer as possible, our Businesses and Markets work closely together in Business-Market Combinations (BMCs) – Image Guided Therapy Systems-DACH (Germany, Austria & Switzerland), for example. The BMC makes agreements where to compete and how to win. Businesses and Markets bear joint accountability for managing the operational end-to-end consumer and customer value chain, Quality & Regulatory compliance and the collaborative P&L, while leveraging the functional excellence and shared infrastructure of the company.

In 2020, the world economy experienced a sharp recession, owing to the lockdown measures taken to combat the coronavirus outbreaks. According to Oxford Economics, global real GDP is estimated to have contracted by 3.9% in 2020, compared with the 2.5% growth estimated in 2019 for 2020. Across Philips’ markets, only Greater China is estimated to have shown growth in 2020, while the rest of the markets all suffered full-year recessions to various degrees. Looking ahead, Oxford Economics expects global real GDP growth to reach 5.0% in 2021.

In a year shaped by the pandemic, Philips helped customers roll out more than 8,000 ICU beds for COVID-19 patients. We quickly introduced the Rapid Equipment Deployment Kit, a self-service 20-bed ICU that can be deployed in hours thanks to remote clinical training, installation, and set-up. We also developed ultrasound solutions for COVID-19 detection at the point of care.

Philips increased ventilator production multifold to meet the high COVID-19-related demand, and shipped ventilators across the world using a fair and ethical approach to allocate supply to acute patient demands based on COVID-19 data and the available critical care capacity. Following Philips’ delivery of 12,300 bundled EV300 ventilator configurations to the US Strategic National Stockpile in line with the contract signed in April 2020, the US Department of Health and Human Services cancelled the delivery of the remaining 30,700 ventilators.

Our commitment to improving lives through meaningful innovation continued in our partnership with the U.S. Department of Defense and Veterans Affairs (VA), where we are working to advance AI technology for early detection of COVID-19 and tele-critical care technologies and services. VA signed a 10-year contract, which enables it to invest up to USD 100 million with Philips to create the world’s largest tele-ICU system and extend access to intensive care expertise for veterans, regardless of their location.

We expanded our strategic relationships with local health systems, including Steward Health Care, which signed a nine-year, multi-vendor services contract with Philips, making us their strategic partner of choice. The University of Kentucky's UK HealthCare worked with Philips to power the state’s only eICU Clinical Command Center, which will help them in care provisioning for COVID-19 patients. In addition, Tampa General signed a seven-year strategic partnership with Philips to provide the hospital with new patient monitoring solutions, imaging equipment, healthcare informatics, workflow solutions and consulting.

Philips Sonicare is the sonic toothbrush brand most recommended by US dental professionals, and our Professional Teledentistry program has made it easier for consumers to maintain wellness from home through the pandemic. Philips maintains a No. 1 market share in male grooming (electric). We are also one of the leading brands in reusable baby bottles and our Pregnancy+ apps are amongst the fastest-growing for new parents.

In 2020 we continued our efforts to provide innovative health technology solutions in support of China's national health strategy, Healthy China 2030 – the action program designed to promote the health of China's 1.4 billion people.

We signed a multi-year contract with the First Affiliated Hospital of Zhejiang University, one of China's leading hospitals, to support its expansion and upgrading. Combining clinical, research and education, this deal includes Ultrasound, Image Guided Therapy and Monitoring Analytics & Therapeutic Care solutions.

Philips helped Beijing Ditan Hospital, a top 3A hospital specially designated for COVID-19 care, to upgrade its ICU facility and capability with IntelliSpace Critical Care and Anaesthesia solutions supporting 41 ICU beds.

Philips provided cardiology solutions, including MR, Digital Subtraction Angiography and customer services, to Hong Kong Asia Heart Center, a private medical group dedicated to the treatment, rehabilitation and prevention of heart disease.

For consumers, we introduced our new SkinIQ range shaver, powered by the breakthrough Philips skin technology SkinIQ, recording record-breaking sales of 30,000 units sold on launch day on Tmall (S5000) and increasing total Male Grooming sell-out by 39% on JD (S7000). We also collaborated with Tmall Innovation Center to launch Philips’ first C2B (Consumer to Business) shaver, with 160,000 pieces selling out in a month – a new benchmark in the industry.

In our international markets, Philips entered into many new customer partnerships, including the following:

In the United Kingdom, Philips was awarded a 7-year strategic partnership with South Tees Hospitals NHS Foundation Trust, with a workforce of around 9,000 providing a range of specialist regional services to 1.5 million people. This collaboration will utilize Philips’ innovative Vue PACS (Picture Archiving and Communication System) technology and VNA (Vendor-Neutral Archiving) capability to support the Trust in connecting and integrating imaging facilities across multiple regional locations to provide seamless image sharing. Following the outbreak of COVID-19, Philips rapidly arranged for delivery of vital health technology equipment and provided remote simulation-based training sessions that enabled life-saving techniques without putting healthcare professionals at further risk.

In Germany, Philips entered into an 8-year strategic partnership Paracelsus Clinics, offering solutions that maximize the availability of imaging systems and leverage digitalization and process optimization to realize quality and efficiency improvements. And we signed a 10-year strategic partnership with Marienhospital Stuttgart to deploy our digital healthcare solutions across multiple departments to improve patient care and efficiency.

In the Benelux, Philips and Flevo Hospital signed a 10-year strategic partnership agreement to support precision diagnosis and optimize workflows and patient pathways, while driving efficiencies and cost optimization. We also renewed our long-term partnership with Alrijne Hospital in Leiderdorp and agreed a 5-year partnership with the Franciscus Gasthuis and Vlietland hospital in Rotterdam. We worked together with Erasmus University Medical Centre, Jeroen Bosch Hospital and the Ministry of Health, Welfare and Sport to launch the COVID-19 portal – a solution to enable hospitals to digitally exchange patient data and images, when COVID-19 patients are relocated between hospitals. Some 95% of Dutch hospitals are connected to the portal.

In France, the strategic partnership signed in 2015 with Hospices Civils de Lyon (HCL) has once again proven to be productive and fruitful. During the first wave of the COVID-19 pandemic, we teamed up to develop an AI-based CT lung assessment tool, the full version of which was launched at the Radiological Society of North America event RSNA 2020.

In Spain, Philips and the Hospital San Joan de Déu in Barcelona signed an agreement to renew the pediatric surgical block, incorporating the most advanced technology for minimally invasive procedures. In this way, surgeons at the Hospital will have high-resolution images, and even augmented reality in real time, of the area on which they are operating.

In Italy, Philips successfully participated in public tenders to supply hospitals fighting the COVID-19 emergency with ICU equipment – including over 3.000 monitors in the first half of the year alone – as well as Ultrasound and Therapeutic Care devices.

In Denmark, Philips’ Clinical Collaboration Platform supports telehealth and other connectivity initiatives to increase collaboration across hospitals, empowering medical image access for over 5,000 clinicians in the Region of Southern Denmark. The Region now has a single system for storing, retrieving, and viewing clinical images across all the locations and specialties in its extensive healthcare system, serving approximately 300 radiologists and nuclear medicine specialists performing 1.5 million exams yearly.

Supporting the Swedish National Board of Health and Welfare, we sped up delivery of IntelliVue X3 monitors to meet the increased care capacity needs of Swedish hospitals in the face of COVID-19.

In Indonesia, Philips signed a seven-year strategic partnership agreement with Mandaya Royal Hospital Puri, providing a turnkey solution combining the latest innovations in enterprise diagnostic imaging, connected care and informatics, as well as service, maintenance and financing.

In South Korea, Philips secured a deal with Sejong Chungnam National University Hospital (CNUH) to provide an extensive range of Diagnostic Imaging and Image Guided Therapy solutions.

In Japan, we launched our Philips Lumify with Reacts handheld tele-ultrasound solution – with a novel subscription model – to enable powerful diagnostics at the bedside.

In Colombia, we signed our first deal for the implementation of EMR (Electronic Medical Record) and interoperability solutions with Santa Fe de Bogota Foundation. The agreement covers the replacement of its central information system with a comprehensive healthcare informatics solution with interoperable digital technology that improves its operational and administrative infrastructure, and overall patient experience.

In Turkey, Philips is a solutions partner of Basaksehir City Hospital. To help fight the pandemic, we installed more than 2,200 clinical and imaging devices across all modalities within three weeks, two months earlier than planned. We also signed a partnership agreement with one of the country's largest dental hospital chains, Dent Group.

In Saudi Arabia, Philips won a strategic deal to supply almost 3,000 patient monitors to help in the fight against COVID-19.

Supporting the increased demand for flexible ICU capacity, Philips introduced its new mobile ICUs in India. The ICUs can be furnished with a range of medical equipment, including ventilators, defibrillators, and patient monitoring.

Philips runs an Integrated Supply Chain, which encompasses supplier selection and management through procurement, manufacturing across all the industrial sites, logistics and warehousing operations, as well as demand/supply orchestration.

Striving for a balanced ‘regional vs global’ approach, the Integrated Supply Chain supports our business expansion, ensuring adequate capacity and speed while leveraging our global processes, standards and capabilities aligned with our industrial footprint strategy to become more efficient and effective.

In order to improve demand forecasting accuracy and manage inventories more efficiently, we piloted the application of artificial intelligence and machine learning in our North American operations in the Personal Health business. We achieved an improved forecast accuracy of more than 20% and better fill rates, leading to increased customer satisfaction. We are now in the process of rolling this out to the rest of the world.

When selecting and evaluating partners, we consider not only business metrics such as cost, quality and on-time delivery performance, but also environmental, social and governance factors. We use supplier classification models to identify critical suppliers, including those supplying materials, components and services that could influence the safety and performance of our products and solutions.

Since 2017, Philips has been consolidating its manufacturing footprint into versatile ‘multi-modality’ manufacturing sites that produce multiple product categories and are located within or near the regions they serve, for enhanced scale, efficiency, and customer proximity. As of the end of 2020, 25 sites have been closed or divested. During the same period, Philips has acquired 10 sites. We have also started to transform our warehousing and distribution operations into a more customer-centric and agile network that is more responsive to market volatility. In the last two years, we have reduced our warehousing footprint by 28% through, among other things, consolidation and servicing of multiple businesses from a single location.

The COVID-19 pandemic has tested the resilience and ingenuity of our people and partners in every part of our integrated supply chain, as we adjusted production capacity to the fluctuations in market demand. We teamed up with partners such as KLM to establish air corridors to enable us to supply essential healthcare equipment and solutions during the lockdown periods. We worked closely with our manufacturing sites as well our suppliers to deal with local (partial) lockdowns and safeguard a reliable supply of components and parts, prioritizing delivery of critical equipment to those in need.

Philips Group

Supplier spend analysis per region

in %

| 2020 | |

|---|---|

| Western Europe | 28% |

| North America | 36% |

| Other mature geographies | 6% |

| Total mature geographies | 70% |

| Growth geographies | 30% |

| Philips Group | 100% |

In 2020, the COVID-19 pandemic resulted in significant disruption to demand and international trade flows. Under these circumstances, the Procurement function was focused on managing uninterrupted supplies to enable Philips to provide critical life-saving healthcare equipment and solutions to our customers all over the world. For example, we had to make a steep ramp-up in the production of ventilators from 1,000 per week to 4,000 per week within a short period of 5 months. This necessitated significant investments in our own plants, as well as close cooperation with our contract manufacturers and parts suppliers, to ensure the availability of the significantly increased capacity. In certain cases, we needed to shift the supplier locations to countries where the impact of the pandemic was low.

For many components, lead times increased significantly, leading to shortages. Market prices for raw materials showed extreme volatility, falling in the first half of the year and recovering from their lows from June onwards, led by a return to manufacturing growth in China. In general, in the second half of the year the economy continued its path to recovery, with manufacturing output and new orders both rising.

Philips’ purpose to improve people’s lives applies throughout our value chain. An important area of focus for the Integrated Supply Chain is sustainability, and we are actively working on this together with our partners, be they suppliers or energy or logistics providers. Close cooperation with our suppliers not only helps us deliver health technology innovations, it also supports new approaches that help us minimize our environmental impact and maximize the social and economic value we create.

Since 2003 we have dedicated supplier sustainability programs as part of our sustainability strategy. We have a direct (tier 1) business relationship with approximately 3,300 product and component suppliers and 16,000 service providers. In many cases, social issues deeper in our supply chain require us to intervene beyond tier 1 of the chain.

We want to make a difference through sustainable supply management and responsible sourcing. This is more than simply managing compliance – it is about working together with our supply partners to have a positive and lasting impact. Therefore, the sustainability performance of our suppliers is fully embedded in our procurement organization and strategy.

In 2020, our focus was on further maximizing our positive impact on the supply chain. Through the Supplier Sustainability Performance program, we improved the lives of 302,000 workers in our supply chain. We also explored new ways to leverage the power of data in our sustainability engagements. Through new use-cases, we are utilizing insights from machine learning to strengthen the efficacy and effectiveness of sustainability performance at our suppliers.

Detailed information on our supplier sustainability programs is available in section Supplier indicators of this Annual Report.

Managing our large and complex supply chain in a socially and environmentally responsible way requires a structured and innovative approach, while being transparent and engaging with a wide variety of stakeholders. In 2020, our programs focused specifically on improving suppliers’ sustainability performance, responsible sourcing of minerals, and reducing the environmental footprint of our supply base.

In 2020, COVID-19 affected the global economy and the company’s results. In the Diagnosis & Treatment businesses, comparable sales*) declined due to the postponement of installations and elective procedures resulting from the impact of COVID-19. In the Personal Health businesses, COVID-19 led to a decline in comparable sales*) due to lockdowns in several countries. The Connected Care businesses recorded comparable sales growth*), as our innovations in both Monitoring & Analytics and Sleep & Respiratory Care were able to help our customers combat the pandemic.

Philips Group

Key data

in millions of EUR unless otherwise stated

| 2018 | 2019 | 2020 | |

|---|---|---|---|

| Sales | 18,121 | 19,482 | 19,535 |

| Nominal sales growth | 1.9% | 7.5% | 0.3% |

| Comparable sales growth1) | 4.7% | 4.5% | 2.5% |

| Income from operations | 1,719 | 1,644 | 1,542 |

| as a % of sales | 9.5% | 8.4% | 7.9% |

| Financial expenses, net | (213) | (117) | (44) |

| Investments in associates, net of income taxes | (2) | 1 | (9) |

| Income tax expense | (193) | (337) | (284) |

| Income from continuing operations | 1,310 | 1,192 | 1,205 |

| Discontinued operations, net of income taxes | (213) | (19) | (10) |

| Net income | 1,097 | 1,173 | 1,195 |

| Adjusted EBITA1) | 2,366 | 2,563 | 2,570 |

| as a % of sales | 13.1% | 13.2% | 13.2% |

| Income from continuing operations attributable to shareholders2) per common share (in EUR) - diluted3) | 1.37 | 1.27 | 1.31 |

| Adjusted income from continuing operations attributable to shareholders2) per common share (in EUR) - diluted1)3)4) | 1.72 | 1.98 | 1.98 |

The composition of sales growth in percentage terms in 2020, compared to 2019 and 2018, is presented in the following table.

Philips Group

Sales

in millions of EUR unless otherwise stated

| 2018 | 2019 | 2020 | |

|---|---|---|---|

| Diagnosis & Treatment businesses | 7,726 | 8,485 | 8,175 |

| Nominal sales growth | 4.9% | 9.8% | (3.7)% |

| Comparable sales growth1) | 6.6% | 5.5% | (2.3)% |

| Connected Care businesses | 4,341 | 4,674 | 5,564 |

| Nominal sales growth | 0.2% | 7.7% | 19.1% |

| Comparable sales growth1) | 2.7% | 3.1% | 22.0% |

| Personal Health businesses | 5,524 | 5,854 | 5,407 |

| Nominal sales growth | (2.8)% | 6.0% | (7.6)% |

| Comparable sales growth1) | 2.3% | 5.0% | (4.2)% |

| Other | 530 | 469 | 389 |

| Philips Group | 18,121 | 19,482 | 19,535 |

| Nominal sales growth | 1.9% | 7.5% | 0.3% |

| Comparable sales growth1) | 4.7% | 4.5% | 2.5% |

Group sales amounted to EUR 19,535 million in 2020, in line with 2019 on a nominal basis. Adjusted for a 2.2% negative currency effect and consolidation impact, comparable sales*) increased by 3%. The negative currency effect was mainly due to depreciation of currencies against the euro and affected all business segments.

In 2020, sales amounted to EUR 8,175 million, 4% lower than in 2019 on a nominal basis. Excluding a 1.4% negative currency effect and consolidation impact, comparable sales*) decreased by 2%, as low-single-digit growth in Diagnostic Imaging, was more than offset by a high-single-digit decline in Image-Guided Therapy and Ultrasound due to the postponement of installations and elective procedures resulting from the impact of COVID-19.

In 2020, sales amounted to EUR 5,564 million, 19% higher than in 2019 on a nominal basis. Excluding a 2.9% negative currency effect and consolidation impact, comparable sales*) increased by 22%, with double-digit growth in both Monitoring & Analytics and Sleep & Respiratory Care, as our innovations in these therapeutic areas were able to help our customers combat the pandemic.

In 2020, sales amounted to EUR 5,407 million, 8% lower than in 2019 on a nominal basis. Excluding a 3.4% negative currency effect and consolidation impact, comparable sales*) decreased by 4%, driven by a mid-single-digit decline in Personal Care, and a high-single-digit decline in Oral Healthcare, mainly caused by lockdowns in several countries.

In 2020, sales amounted to EUR 389 million, compared to EUR 469 million in 2019. The decrease was mainly due to lower royalty income.

Philips Group

Sales by geographic area

in millions of EUR unless otherwise stated

| 2018 | 2019 | 2020 | |

|---|---|---|---|

| Western Europe | 3,990 | 4,134 | 4,613 |

| North America | 6,338 | 6,951 | 6,949 |

| Other mature geographies | 1,892 | 1,905 | 1,860 |

| Total mature geographies | 12,221 | 12,990 | 13,422 |

| Nominal sales growth | 2.5% | 6.3% | 3.3% |

| Comparable sales growth1) | 3.3% | 2.1% | 3.9% |

| Growth geographies | 5,901 | 6,492 | 6,113 |

| Nominal sales growth | 0.7% | 10.0% | (5.8)% |

| Comparable sales growth1) | 7.6% | 9.6% | (0.3)% |

| Philips Group | 18,121 | 19,482 | 19,535 |